The GWAV reverse split has recently captured investors’ attention. Greenwave Technology (GWAV) announced this critical financial move in an attempt to meet NASDAQ’s listing requirements. A reverse split is a strategy companies use to boost the value of their shares by reducing the total number of shares in circulation. This decision can impact the market perception of the company and its stock price, so understanding its implications is key for any investor.

The GWAV reverse split aims to strengthen the company’s stock price and improve its position in the stock market. While this move often creates uncertainty for existing shareholders, it can also signal that the company is working towards stabilizing and achieving long-term growth. This blog post will discuss the reasons behind the reverse split and explore what it means for current and potential investors.

What Is a GWAV Reverse Split and Why Does It Matter?

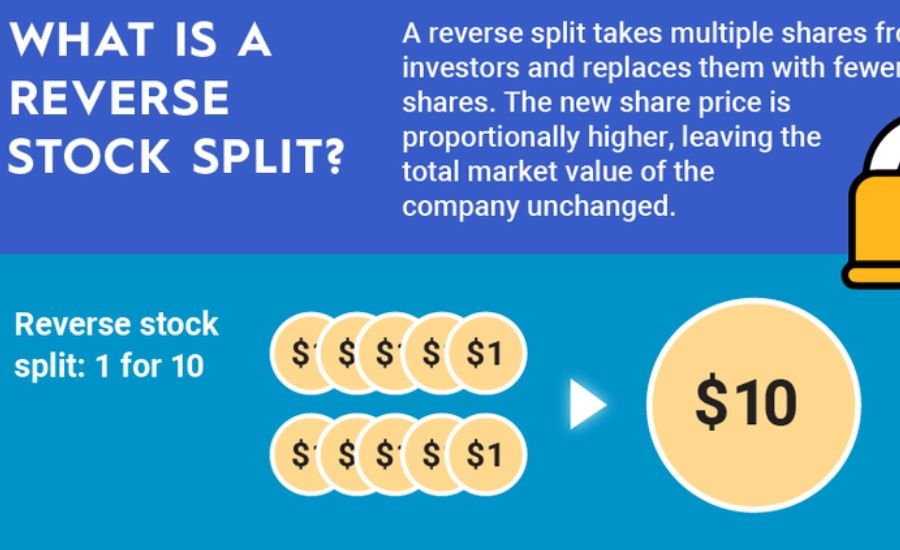

A GWAV reverse split is a move made by Greenwave Technology (GWAV) to change its stock price by reducing the total number of shares. This financial strategy helps the company to increase its stock value by merging shares. For example, if someone owns 10 shares, they may now have 1 share after the split. This doesn’t change the total value of their investment, but it may help the company meet specific requirements, like those of NASDAQ.

Understanding the GWAV reverse split is essential for any investor, as it may affect the stock’s behavior. Some investors see this move as a sign of positive change, while others might be concerned about what it means for the company’s future. Essentially, a reverse split is like “reshuffling” shares without changing the company’s overall worth. Still, it can impact how investors feel about the stock’s stability.

How the GWAV Reverse Split Impacts Stockholders

The GWAV reverse split affects stockholders by changing the number of shares they hold. If a person had 100 shares before the reverse split, they might only have 10 after. However, the price of each share will increase to reflect the new number of shares. This doesn’t mean that the investment’s total value will change immediately. Still, it could impact how others view the stock’s potential.

For some investors, the GWAV reverse split may make the stock seem more attractive, as the share price is higher. For others, it may be seen as a sign of trouble. A reverse split can make the stock look healthier, mainly if it trades at a low price. However, keeping an eye on the company’s performance after the split is essential to see if the move benefits the shareholders in the long run.

The Financial Strategy Behind the GWAV Reverse Split Explained

The main reason for the GWAV reverse split is to help the company meet specific financial requirements, such as staying listed on NASDAQ. NASDAQ has strict rules about the minimum stock price a company must maintain. If a company’s stock falls too low, it risks being removed from the exchange. Greenwave Technology can raise its stock price by conducting a reverse split and keeping its place on NASDAQ.

This move allows the company to avoid being removed from the stock market. Investors need to understand that while a reverse split does not change the company’s value, it might help improve the stock’s perception. The reverse split can give investors a reason to feel more confident about the company’s future, showing that it is taking steps to maintain its market position.

Is the GWAV Reverse Split a Sign of Financial Health or Trouble?

The GWAV reverse split can be seen as a sign of financial health or trouble.

Signs of Financial Health

On one hand, companies perform reverse splits to keep their stock price higher and avoid being delisted. This shows they are serious about staying on the market and maintaining their position.

Signs of Trouble

On the other hand, some investors see reverse splits as a last-ditch effort to fix a falling stock price. While they may temporarily increase the share price, they don’t solve the root cause of any financial issues the company might face. Therefore, investors must keep track of the company’s overall performance to determine whether the reverse split is a smart move in the long run.

The Risks and Rewards of Investing After the GWAV Reverse Split

Investing in GWAV after a reverse split comes with both risks and rewards.

The Rewards

One reward is that the company’s stock price may appear more substantial and attractive to investors. A higher share price may encourage more people to invest in the company.

The Risks

However, there are risks to consider as well. The reverse split doesn’t guarantee that the company will improve financially. While the higher share price might make the stock more appealing, investors must look beyond the price. The company’s performance, future growth potential, and overall market conditions will play a much more significant role in determining the success of any investment.

What Investors Should Know About the GWAV Reverse Split and NASDAQ Compliance

The GWAV reverse split primarily ensures that the company stays listed on NASDAQ. NASDAQ has strict rules about the minimum stock price a company must maintain. If a company’s stock falls too low, it risks being removed from the exchange. A reverse split, like the one GWAV is conducting, can raise the stock price by reducing the number of shares.

Importance of NASDAQ Compliance

Understanding this connection between the reverse split and NASDAQ compliance is crucial for investors. This move shows that the company is taking action to meet these requirements and prevent a delisting. However, while this may seem like a positive step, investors should continue to monitor the company’s financial health. A reverse split doesn’t fix a company’s underlying issues, so ongoing performance is key.

Will the GWAV Reverse Split Help or Harm Long-Term Investors?

The impact of the GWAV reverse split on long-term investors is still uncertain. It could help raise the stock price in the short term, making it more appealing to investors. This might lead to some short-term gains. However, the long-term success of the split will depend on whether Greenwave Technology can sustain this positive momentum after the reverse split.

Potential Benefits for Long-Term Investors

For long-term investors, it’s essential to think beyond the initial changes. The reverse split doesn’t affect the company’s fundamentals, so investors need to focus on how the company performs in the coming months and years. The reverse split could benefit long-term investors if the company uses this opportunity to improve its business strategy and financial health.

Understanding the Mechanics of a Reverse Stock Split with GWAV as a Case Study

The GWAV reverse split is an excellent example of how reverse splits work. A reverse split doesn’t change the total value of the investment for shareholders but adjusts the number of shares they hold and the price of each share. For example, if you own 100 shares of GWAV before the split, you might end up with 10 shares, but each share will be worth more, making the total value the same.

Key Takeaways from GWAV’s Case

It’s important to understand that the reverse split does not solve the company’s underlying problems. It’s a strategy to meet listing requirements and make the stock look more attractive. In GWAV’s case, this decision helps the company remain listed on NASDAQ. For investors, understanding these mechanics is key to making informed decisions about their investments.

How the GWAV Reverse Split Could Affect Future Stock Performance

The future stock performance of GWAV after the reverse split will depend on several factors, including the company’s overall strategy, market conditions, and investor sentiment. A higher stock price may initially boost investor confidence, but the company’s long-term performance will really determine its success.

Learn More Here: FintechZoom MULN Stock

Factors to Watch for Future Performance

Investors should keep an eye on how Greenwave Technology performs after the split. Suppose the company can use the reverse split to improve its business practices and boost revenue. In that case, the stock price might continue to rise. On the other hand, if the underlying financial challenges remain unaddressed, the stock could face further challenges despite the reverse split.

Looking Ahead: What Happens After the GWAV Reverse Split in 2025?

Looking ahead, investors should watch how Greenwave Technology moves forward after the GWAV reverse split in 2025. The company has tried to stabilize its stock price and avoid delisting from NASDAQ. However, it’s crucial to understand that this is just a short-term solution.Investors should stay informed about the company’s progress, any new developments, and whether the reverse split results in real improvements.

What to Expect After the Split

For those considering investing in GWAV post-split, the key will be to evaluate the company’s ability to use the reverse split as a stepping stone to better performance. Watching the company’s quarterly earnings and future announcements will provide valuable insight into whether this move leads to long-term success.

Conclusion

In conclusion, the GWAV reverse split is a financial move made by Greenwave Technology to boost its stock price and meet NASDAQ’s listing requirements. While it doesn’t change the overall value of an investor’s shares, it can impact how the stock looks to the market. For some investors, it may be a sign of positive change. In contrast, for others, it raises concerns about the company’s financial health. Pay attention to how the company performs after the reverse split to see if the move was successful in the long run.

Investors should stay informed and continue to evaluate Greenwave Technology’s progress after the GWAV reverse split. While the reverse split can provide a temporary boost, the company’s ability to improve its financial situation and business strategy will determine its future. By staying up-to-date with the latest news and looking beyond the stock price, investors can make better decisions and understand what this move means for their investments.

FAQs

Q: What is a GWAV reverse split?

A: A GWAV reverse split is when Greenwave Technology reduces the number of its shares and increases the share price, keeping the overall value the same. This move helps the company meet NASDAQ’s listing requirements.

Q: How does the GWAV reverse split affect my shares?

A: After the reverse split, you will own fewer shares, but each share will be worth more. Your total investment value won’t change, but the price per share will increase.

Q: Why did Greenwave Technology do a reverse split?

A: Greenwave Technology conducted the reverse split to raise its stock price and comply with NASDAQ’s rules for maintaining its listing on the exchange.

Q: Will the GWAV reverse split increase the value of my investment?

A: A reverse split doesn’t automatically increase your total investment value. It can make the stock price more attractive, but long-term growth depends on the company’s performance.

Q: Does the reverse split mean Greenwave Technology is in financial trouble?

A: Not necessarily. While some view reverse splits as a sign of financial struggle, Greenwave’s reverse split is more about meeting NASDAQ’s requirements than a sign of economic instability.

Q: How will the reverse split affect the stock price?

A: The stock price will rise after the reverse split, but the total value of your investment won’t change. The price per share will increase, but the number of shares you own will decrease.

Q: Should I buy GWAV stock after the reverse split?

A: Whether or not you should buy GWAV stock depends on the company’s future performance. The reverse split doesn’t guarantee growth, so it’s vital to research Greenwave’s long-term outlook before making any decisions.

See Also: DavidCorenswet